Do Virginia Photographers Need to Collect Sales Tax on Digital Photographs?

One of the biggest controversies in the photography community of VA is whether to collect sales tax on digital images or not. So why is this such a controversial topic? Well, if you call the VA Department of Taxation and speak to 3 different representatives it is likely that you will get 3 different answers ( I know from experience). If you contact a CPA it is likely that you will also hear 3 different answers. So what are we supposed to do?

The law clearly states that sales tax is to be collected on "tangible" products. There is no doubt that albums, prints, canvas, CDs or flash drives are tangible and therefore taxable. Those are physical products that you can touch, feel and hold in your hands. In the age of digital technology, however many photographers are delivering their images through an online gallery and giving their clients the right to use whichever printing company they'd like. This method is referred to as "Shoot & Share". The client downloads their images right from the gallery onto their computer and have the freedom to order products from any printing company they'd like. Often times no tangible products are ever exchanged between the photographer and the client. The question is, should sales tax be collected in this situation? Unfortunately there is no simple answer to this question, but let's begin by looking at the Law and how it is written.

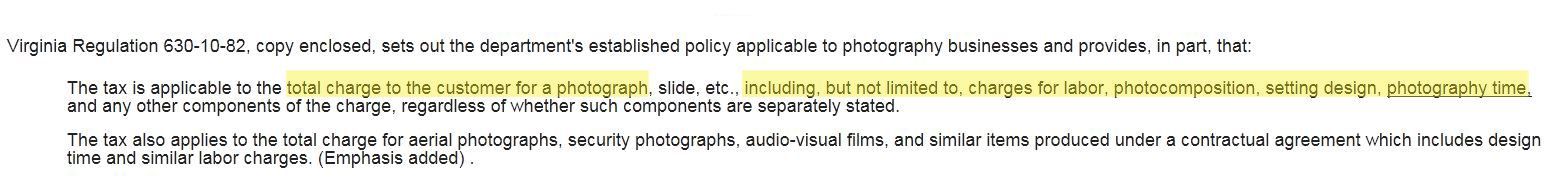

The law is pretty clear, but again what is not clear to many is that word "photograph". Does it refer to digital photographs delivered strictly via the internet? When this law was written, because of the date, I can assume it was written before the digital age and was referring to film. Obviously the only way to deliver film was through prints or proofs, both tangible products. I'm going to share with you information that I received from 2 different representatives from the VA Department of Taxation via online chatting (as of 2015, due to budget cuts, chatting is no longer available). This was the only time I received the exact same information from two different agents.

Here is a summary of what I was told:

Photographers in the state of VA DO NOT need to collect sales tax when delivering digital files via the Internet (this does not refer to CDs or flash drives). Tax is ONLY collected on tangible products. Digital files ARE NOT considered a tangible product.

Ok this seemed to jive with what I've been told by the other agents I spoke with and what a lot of other photographers and CPAs believe. Wait though there's more...

HOWEVER, if the client purchases a print (or any other product) from an online gallery the photographer MUST collect tax on the ENTIRE package and service, not just the print itself. So, let's use a wedding package for example. If your wedding package includes digital files and your services for $3000 and the couple chooses to order prints from your gallery after the wedding and final payment as been made, you MUST charge them sales tax on the entire amount of $3000. So that $2 print (if you follow the true Shoot & Share way) will have a sales tax of $159. Ouch!

Only two representatives explained that part to me. This is a common misperception of those photographers who choose to accept that digital files are non-taxable. I don't know about you, but that $159 looks a whole lot worse calculated into a $2 print then if it was calculated into a $3000 package! Assuming this information is accurate it makes more sense to collect tax in the beginning regardless of whether the client chooses to purchase any tangible products (prints, albums, etc) or not.

There are several CPAs who will tell you with 100% certainty that digital files ARE considered tangible products and therefore sales tax MUST be collected (that's what my CPA has told me).

Wait, didn't we just solve this issue? I mean I have confirmed information from 2 different representatives, so why isn't this the end of my blog post?

Here's why - I attended a workshop hosted by a VERY successful and well known photographer whose wedding packages begin at $7000. This photographer is known on a national level and quickly gaining recognition on an international level. During her workshop the issue of sales tax came up (shocking I know) and she shared with us her experience of being audited and fined $10,000 in fees and back sales tax because she, like so many other photographers, did not believe sales tax needed to be collected on digital photographs. Clearly the VA Department of Taxation disagreed. I believe the majority of photographers out there want to follow the law and want what is best for their clients. Those not collecting sales tax believe they are doing what is right. Those collecting sales tax are also doing what they think is right. It's disappointing that good honest people are getting into trouble because there is a lack of consistency regarding this topic.

Hearing first hand from the photographer herself was enough to convince me. I collect sales tax from every single client right from the beginning. I believe it is the ONLY safe route there is. I didn't like it at first, but I've never had a client complain or question the tax. I've never lost a sale over sales tax. Having worked in the educational system for 12 years and never getting accurate information from the ones overseeing everything (that's a whole other blog post) I am not surprised that The Department of Taxation operates in the same manner.

I am not a tax expert. I am only sharing my own experiences and opinion. This is how I've chosen to handle the age old question of sales tax and digital photos. I encourage you to research this topic further. A good place to start is the VA Department of Taxation, but good luck navigating through their website. They certainly don't make it easy!

You may also be interested in

Join Facebook Group Community Over Competition With Sarah Kane